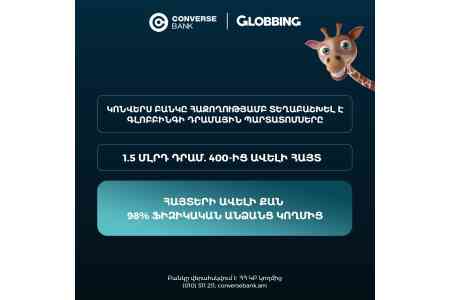

ArmInfo. Converse Bank has successfully completed the initial public offering of Globbing's (Global Shipping LLC) first dram-denominated registered coupon bonds ahead of schedule, totaling 1.5 billion drams. Additionally, on January 5, Converse Bank also completed an early placement of Globbing's debut dollar-denominated bonds totaling $2 million.

The bank announced that these bonds will be listed on the Armenian Stock Exchange for the secondary market trading. The initial public offering of these issues was scheduled to commence on December 12, 2025, and close on February 12, 2026. However, the underwriter, Converse Bank, completed the placement well ahead of the planned timeline.

The AMD tranche (AMGLBSB21ER0) includes 30,000 bonds, each with a par value of AMD 50,000, while the USD tranche (AMGLBSB22ER8) includes 20,000 bonds, each with a par value of USD 100. The coupon yield on the AMD bonds is set at 12%, while on the USD bonds it is 8.25%. The maturity of both issues is 36 months (3 years). Coupon payments for both tranches are scheduled to be semi-annual. Full redemption of both issues will take place on December 12, 2028.

The bank's statement noted that both Globbing's dram and dollar bonds were in high demand, primarily among individuals. An unprecedented number of applications from private investors-over 400-was registered, demonstrating strong demand for the bank's financial instruments and confidence in Globbing. Converse Bank plans to continue issuing and placing corporate securities, facilitating the development of financial market instruments and creating new opportunities for clients to invest in bonds of various companies and for issuers to attract financing.

Globbing (Global Shipping LLC) is an international trading platform that allows customers to make purchases from international stores and receive them in Armenia. Founded in 2015, it employs over 150 people and has warehouses in eight countries (USA, UK, China, UAE, Greece, Germany, Italy, and Russia). The company's head office and branches are located in Armenia, as well as the largest network of parcel lockers (approximately 140 lockers and 3,800 safes). The company has over 1 million registered users, and the number of parcels sent to date exceeds 8.8 million.

According to the Financial Rating of Armenian Banks as of September 30, 2025, prepared by ArmInfo Investment Company, Converse Bank, one of the leading bond issuers in the country, raised AMD 27.2 billion ($71.1 million) from its own bonds. Over the past three years, the bank has doubled this figure, increasing year-on-year by 35%. It should be noted that Converse Bank, as an underwriter, successfully and ahead of schedule placed bonds of Euroterm CJSC (trade brands "Noyan" and "Menk") in dram amounting to 500 million, Medical LLC (Hyebrid) in dram amounting to 100 million, and the Vardanants Innovative Medical Center (Arinterlev CJSC) in dram amounting to 1 billion from 2023-2025. Globbing has also joined this list, choosing Converse Bank as the underwriter for its debut issue of dram and dollar bonds. This move, as expected, ensured the early placement of both the dollar and dram tranches.